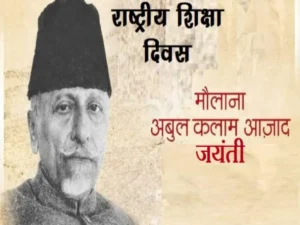

About National Education Day 2023:

Nelson Mandela is credited with saying, “Education is the most powerful weapon which you can use to change the world,” which is relevant to National Education Day. November 11, 2023, is recognised as “National Education Day” worldwide. This article will teach you how a good education is the foundation for all knowledge, including wealth-building investing strategies.

Learning how to make stock market investments is one of the most common financial lessons. A lot of people decide to invest in the stock market in order to secure their long-term financial goals and increase their wealth. This inclination stems from stocks’ historical superiority over other asset classes.

For most people, learning about the market comes from books, friends, and everyday encounters. Developing a winning investment plan can be challenging, even though there are simple and easy investment opportunities. Even though the stock market offers a level playing field, many people struggle with steady profitability. At this point, education becomes crucial. It is a dedication to lifelong learning that develops patient, disciplined, and goal-oriented investors.

Examining stock education as a tried-and-true method of wealth accumulation for knowledgeable and conscientious investors, it is helpful to pay close attention to tactics that promote wealth accumulation over the long run. These consist of:

1) Acquiring knowledge of long-term investing methods

Long-term investments are any assets held for a period longer than three years.

After learning the fundamentals of long-term investing, one stops making impulsive changes to their portfolio in response to brief market swings, even when the investments’ short-term value is still relatively low.

2) Educating oneself on value investing

Finding inexpensive stocks is largely dependent on having a well-rounded education. Value investors actively look for stocks that are undervalued, a sign that they think the stock is worth more than it is now being sold for.

Value investors are astute financiers who aim to invest in businesses that they believe have the potential to grow and turn a profit in the future, rather than just searching for cheap stocks. In order to spot indications of cheap stocks, value investors must continue to actively monitor the market and keep up with current events. Since value investors frequently have to wait for their investments to pay off, patience is another essential quality.

3) Acquiring knowledge about dividend reinvestment

Choosing dividend stocks means committing to a long-term investing plan. A steady income stream is typically more important to dividend stock investors than capital growth. While dividend investors may prioritise consistent income over capital growth, dividend stocks have the potential to yield both.

Gaining insight into the market is essential to identifying top-performing dividend-paying stocks that can create a reliable stream of income. It’s critical to use careful market observation and education to identify which stocks, out of the multitude, would add long-term value to your investing portfolio.

4) Determining which industries will profit from cyclical themes

Sector rotation is an investment strategy that involves moving money from one stock market sector to another in response to changes in the overall state of the economy. This strategy is based on the idea that some industries perform better than others at different stages of the economic cycle.

For example, during a recession, defensive industries like technology and healthcare are frequently overshadowed by cyclical industries like utilities and consumer staples. The justification for this is the enduring need for necessities like food and electricity, which persists even in times of economic recession.